- Problem Definition

After MARR identified in previous blog, now Economist need to analyze the Project whether it will be investable or not based on calculated 15.13% MARR as a discount rate. Currently there are another 2 proposals of with similar scope prepared by another Project Team for other Client. However due to resources availability they need to select only 1 Project to be proceed.

- Identify the Feasible Alternative

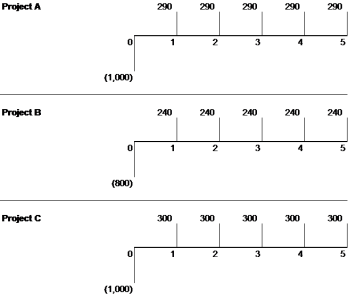

With MARR had been identified, to investigate which Project will be proceed, Economist Team could analyze utilizing Equivalent Worth method such as Present worth (PW), Annual worth (AW) and Future worth (FW) of below alternative.

Figure 1: Alternatives cash flow figure

- Development of the outcome for Alternative

a. Present Worth

In general words, it is a future amount of money at specific point in time. Calculating the present value assumes that we knows both the future amount and the applicable discount rate. Utilizing these information we could identified the present value.

b. Future Worth

The future value is used to calculate what the value at a future date would be for a series of periodic payments

c. Annual Worth

Annual worth (AW) Analysis is equivalent uniform annual worth of all estimated receipts (income) and disbursements (costs) during the life cycle of a project

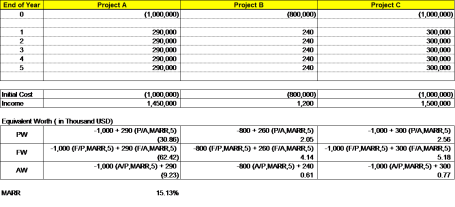

Below is the calculation table

Table 1: Equivalent worth calculation

4. Selection of Criteria

a. Present of Worth

This method is based on the concept of equivalent worth of all cash flows relative to some base or beginning point in time called the present. All cash inflows and outflows are discounted to the present point in time at an interest rate that is generally the MARR.

A positive PW for an investment project is a dollar amount of profit over the minimum amount required by investors. It is assumed that cash generated by the alternative is available for other uses that earn interest at a rate equal to MARR.

b. Future Worth

The FW is based on the equivalent worth of all cash inflows and outflows at the end of the planning horizon at an interest rate that is generally the MARR.

c. Annual Worth

AW of a project is an equal annual series of dollar amounts, for a stated study period, that is equivalent to the cash inflows and outflows at an interest rate that is generally the MARR

5. Analysis and Comparison of the Alternatives

From the result, then Project A is fail since PW, FW and AW amount is less than 0. While Project B and C both meet the selection criteria.

6. Selection of the Preferred Alternative

Table 1 result can be summarize as follow:

- PW : Project C > Project B > Project A

- FW : Project C > Project B > Project A

- AW : Project C > Project B > Project A

From above result, Project C is selected since it slightly higher than Project B.

- Performance Monitoring and the Post Evaluation of Result

Since the result is so tight, then Project Team should ensure the Proposal could meet estimation basis. To optimize the profit, proper control and monitoring should also be done to mitigate the risk.

References :

- Sullivan, W. G., Wicks, E. M., & Koelling, C. P. (2012). Evaluating single project. InEngineering economy(15th ed.). Harlow, England: Pearson.

- Sullivan, W. G., Wicks, E. M., & Koelling, C. P. (2012). Comparison and selection among alternatives. InEngineering economy(15th ed.). Harlow, England: Pearson.

- Financial Dictionary (2015) Retrieved from :http://financial-dictionary.thefreedictionary.com/Present+Worth

- Engineering Tool box Retrieved from :http://www.engineeringtoolbox.com/present-value-d_1233.html

- Paska, H. M. (2015, May). W12_HMIP_Prioritization Project portfolio using IRR, ERR and Payback Period Method | GARUDA AACE 2015. Retrieved from https://garudaaace2015.wordpress.com/2015/05/18/w12_hmip_prioritization-project-portfolio-using-irr-err-and-payback-period-method/

- Darwito, R. (2015, August). W19_RD_ Contract Preparation (Part 5: Minimum Acceptable Rate of Return Analysis – Contractor Side) | GARUDA AACE 2015. Retrieved from https://garudaaace2015.wordpress.com/2015/08/01/w19_rd_-contract-preparation-part-5-minimum-acceptable-rate-of-return-analysis-contractor-side/

AWESOME….!!! Great to see you combining two different tools- Financial Analysis PLUS multi-attribute decision making….!!! This is really a sign that you truly do know and understand how to use the tools/techniques in your tool box!!

Let’s wrap up the blogs and start to prepare for the bid project which is coming up shortly….

BR,

Dr. PDG, Jakarta

LikeLike